Business Financial Obligations

페이지 정보

작성자 Alphonso 작성일25-05-13 22:41 조회2회 댓글0건관련링크

본문

As a business owner, managing financial responsibilities and navigating potential audits can be a daunting challenge. However, 税務調査 税理士 費用 having the right techniques in place can help reduce the risk of non-compliance and associated fines. In this article, we'll delve into fiscal best practices and audit best practices that can help businesses stay on track.

Accurate Financial Record Keeping is Key

Maintaining accurate financial records is the the cornerstone of fiscal responsibility. Businesses should maintain detailed records of all financial income, expenses, including revenue, expenses, receipts, and invoices. This information should be correctly categorized and saved in a secure location, both digitally and manually.

Regular Financial Statement Review and Audit

Regularly reviewing financial accounts can help businesses detect potential errors and inaccuracies. Companies should schedule quarterly reviews of their financial statements to ensure accuracy. Auditing internal financial controls can also help identify areas for improvement and potential challenges.

Correct and Complete Tax Filings

Tax filings are critical part of fiscal compliance. Businesses should ensure they are filing all necessary tax returns, including income tax, sales tax, and payroll tax. Precision and fullness are crucial, as any mistakes or exclusions can lead to costly penalties.

Timely Payment of Taxes

The timely remittance of taxes is essential to avoid late remittance fines. Businesses should set up a system to manage tax remittances, ensuring that all taxes are paid on or before the due date.

Electronic payment options can also help simplify the payment process.

Communication with Tax Authorities

Effective communication with tax agencies can help resolve any concerns or discrepancies. Businesses should maintain open lines of communication with tax agencies and immediately respond to any inquiries or queries.

Business Continuity Planning

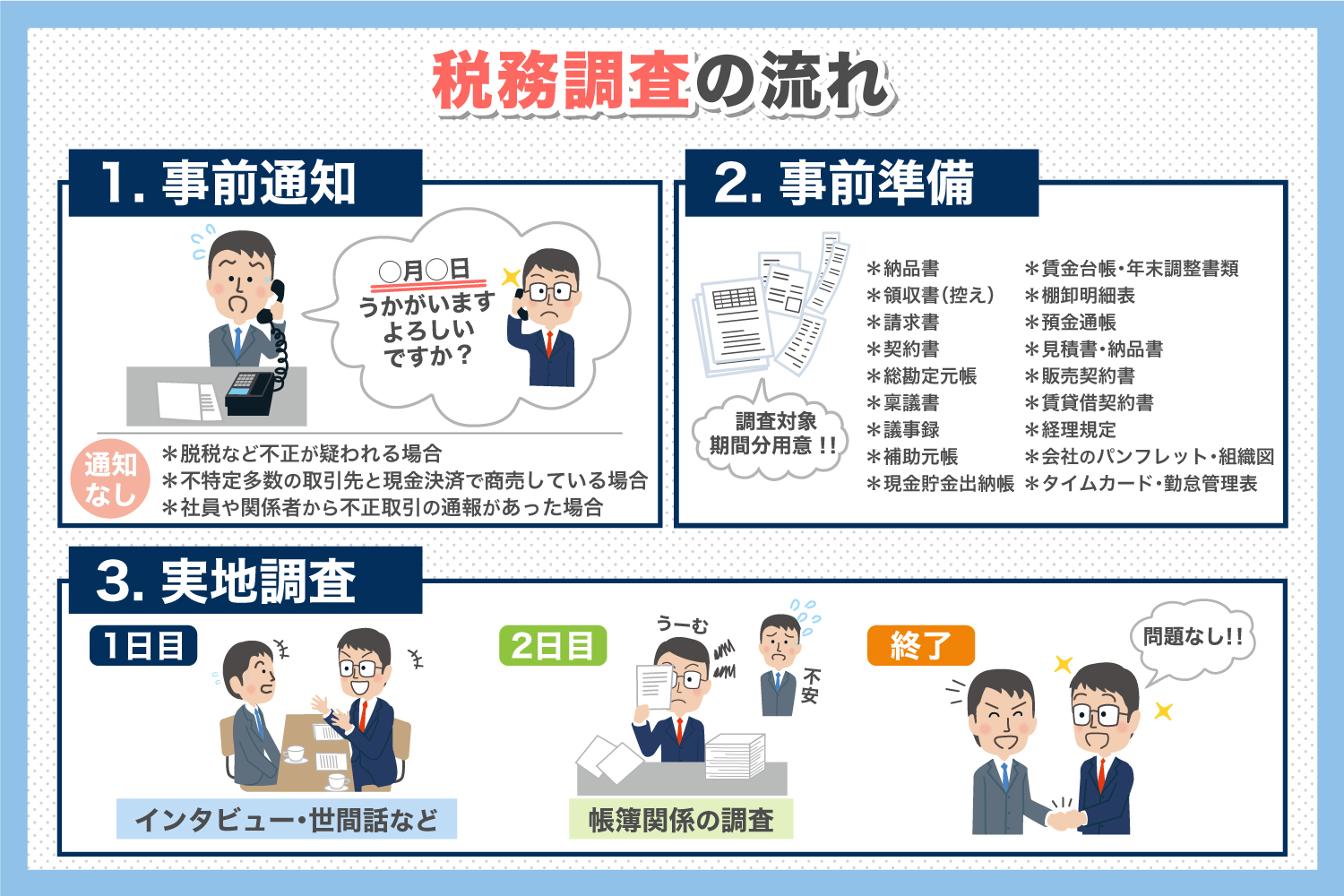

Unexpected audits can be difficult, but having a business continuity protocol can help mollify the impact. This plan should a clear communication approach, a duplicate of financial documents, and a system for managing the tax inspection process.

Professional Guidance

Tax law can complex, and obtaining professional guidance can help guarantee compliance. Businesses should retail the services of a qualified tax specialist to provide advice on tax planning and compliance.

Continuous Training and Education

Tax laws and regulations are constantly evolving, so it's essential for enterprises to stay up-to-date with the latest developments. Providing employees with continuous training and training on tax compliance can help guarantee they are aware of the company's tax policies and processes.

Conclusion

Tax compliance and audit best practices are for businesses to avoid onerous penalties and testimonial damage. By retaining accurate financial documents, regularly reviewing financial accounts, and submitting correct and complete tax returns, businesses can minimize challenges and ensure compliance. Regular communication with tax agencies and having a business continuity plan in place can also help in managing audits and circumstances. Seeking professional guidance and ongoing education are essential to stay on top of tax compliance and navigate potential audit situations.

댓글목록

등록된 댓글이 없습니다.